Where did this idea come from that I have to pay tax on my real estate to educate kids that aren’t even mine? Massachusetts Bay Colony, 1647 – that’s where. Yup. The Puritans. We’ve been paying ever since.

We start with the (seemingly basic) proposition that having children is a private lifestyle choice. Right. So how did it become somebody elses’ lifestyle choice that we all are paying for?

Ever run into people who don’t have kids? It’s becoming quite a “thing”.

Recent Gen “X” and Millennial generation polls throw cold water on any presumption that they yearn for kids and are laser-focused on career paths or other preparations to start a family. They don’t seem all that interested in reproducing. I can’t blame them. Having kids is an extremely expensive, lifelong commitment.

Recent generations don’t seem to crave cars all that much, either. Some don’t even have a drivers license – that little slip of paper fellow members of my Baby Boomer generation would have killed for.

A recent Apartment List Survey (2021) of “Gen Z”, “Younger Millennials” and “Older Millennials” strongly suggests that many don’t view home ownership as a “critical” financial goal anymore.

Apparently, these things are just not as important as they used to be.

Why?

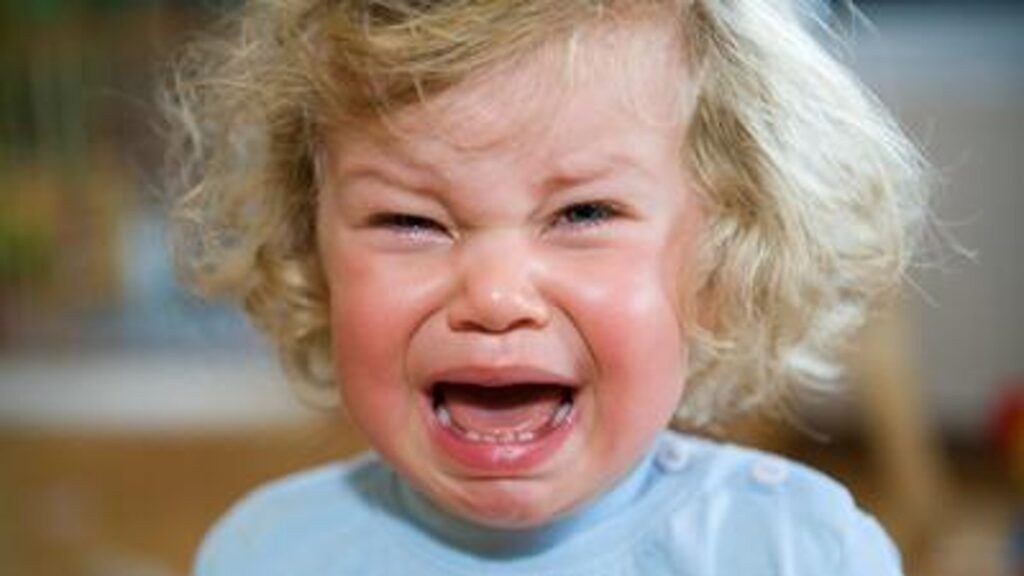

Times are changing. Priorities are changing. The “Need to Breed” is weakening. And the secret is out: Kids are a colossal pain in the ass. True – children can be wonderful and fulfilling – yada, yada, yada... But this life “adventure” ain’t for everybody. We all know people who should never have reproduced. And the headwinds are significant.

“Family Life” ain’t all it’s cracked up to be. Divorce is crippling. Child Support is positively vampyric and Domestic Relations Laws and the Family Court Judges that administer them are batshit insane. Buying an affordable house for everybody to live in is almost impossible. Food prices are off the charts.

*MY FUNDAMENTAL QUESTION: WHY DOES SOCIETY MAKE YOU PAY TO EDUCATE EVERYBODY ELSE’S KIDS – EVEN IF YOU’VE NEVER SIRED A BUNDLE OF JOY?

*MY FUNDAMENTALLY UNVARNISHED ANSWER: BUILD SCHOOLS NOW AND PAY FOR EVERYBODY’S BROOD OR BUILD PRISONS LATER WHEN THE LITTLE URCHINS GROW UP AND GO ROTTEN.

Now that’s a gun to the head if I’ve ever heard one.

Read State Education Commission Studies. Federal Health, Education and Welfare Reports. Pennsylvania, Illinois, Nevada, Ohio, Oregon, New Jersey and California State Education School Tax Commission Reports.

The conclusion is always the same: Fear of Crime. You see, dumb kids = crime. Result?

Everybody pays for everybody else’s offspring. How? Through the only tax artifice that is still a sure bet: real estate. You can’t escape. And it’s Extortion – pure and simple.

Tory Turner’s 4/18/2016 NPR article, “Why America’s Schools Have A Money Problem” gives us some context.

In 1647, Massachusetts Bay Colonists were worried. New neighbors were arriving daily and many could not read. Puritans considered literacy key to the survival of their faith: teach every child to read so that every child could read the Bible.

So, the Massachusetts Bay Colony created a remarkable new law: The Massachusetts School Law of 1647.

The law’s preamble is stunning: “It being one chief project of that Old Deluder , Satan, to keep men from the knowledge of the scriptures…..”

It ended with a mandate that towns with more than fifty families must hire a teacher. The law provided that “….the teacher’s wages will be paid for either by the parents or Masters of such children or by the inhabitants in general”.

Clearly, if parents couldn’t – or wouldn’t – pay for their offspring, the “inhabitants in general” were on the hook. How did this all work out? Local money from taxes on real estate became the go-to source for public education financing. Back then, all weath was land wealth, hence land tax was the way to go.

And it was all because of the Devil. The “Old Deluder”.

Google “Why pay to educate other people’s kids?” and not-so-subtle “systemic” bias in favor of public education fills the screen. The status quo always wins.

– “Is the esoteric benefit of educating other people’s kids smaller than the cost of not doing it? It most certainly is! Think of the children!”

– “Why can’t we all decide – by Vote – whether it’s a program we all want to bankroll – after all, not all of us have kids…. Because we all benefit, that’s why!”

– ” Why do we – a childless couple – who own a home have to pay a school tax or other levy? Because public education benefits us all!”

– “Is this all about the hope that public educated children will be paying off my Social Security and Medicare some day? Yes!! They are our future!”

– “Do you want to live in a country of uneducated people? No!!! We all benefit from having a well educated populace!”

– “Public schooling and curriculum based on informed parental judgment is the key – paid for by us all because we all benefit. Let’s follow the science!”

– “Does anyone get a tax credit from Home Schooling their kids or a reduction of their real estate tax bill? No because the bulk of our communities prefer public schools paid for by us all. Our children are worth it!”

– And finally, WINNER-WINNER-CHICKEN-DINNER:

“Every child is an investment in our collective future”.

Bingo.

A supposedly “Authoritative” article on this subject is authored by Donna Mitros, PhD. (6/27/11) entitled “The Social and Economic Benefits of Public Education: Pennsylvania’s Best Investment”.

Ahhh, Pennsylvania. Brought to you by Quakers.

This frothy glass of Kool-Aid starts with the general proposition that “The national importance of education is based on the significant positive influence it has on individual lives and the welfare of communities”.

Dr. Mitros is a big believer in the so-called “Social Multiplier” Theory of Public Education – and why wouldn’t she? She’s got an academic PhD. in Education and oodles of skin in the game. She posits: “Well educated people are less likely to engage in criminal activity. It is an important buffer between an individual and the likelihood they will commit a crime”.

Confused? Don’t be. This ain’t no “Education is its own reward” philosophy. This is Big Brother writ large. Ayn Rand, she ain’t.

Tortured logic follows in turgid prose:

“Children are the means by which parents reproduce themselves – but are also the way in which Society reproduces itself. Society, therefore, has an interest and we all stand to gain”.

“By providing public education (ie. supplementing the education dollars parents can spend on their children) we -society- make these children, and by implicaton their parents, better off!”

There’s alot to unpack in this article and I hope you read it. Suffice to say it’s mostly (what we now call) wokism. Lefty liberal pablum to shame us into going along to get along – or else. The Specter of an ever-lurking boogeyman, CRIME, is never far behind. Pay your taxes and shut up is the undercurrent.

Dr. Mitros is getting paid big bucks to shill for the Teacher’s Unions and enjoying a tidy, well-paid and tenured Professorship somewhere. Nice work if you can get it.

But what about the rest of us? You know – the people that pay the freight for this broken, Property Tax- based “Public Education Finance” system…

Consider the Garden State. Ground Zero for every urban blight and tax brainfart that ultimately infects everywhere else in our Country. Wherever the United States is going, New Jersey is gettin’ there first.

Property values vary a lot from neighborhood to neighborhood, so New Jersey “Distributes” tax dollars (in their opinion) “Equitably”. The Feds barely contribute 10%.

Look at heavily urban areas like Camden. County and State tax money fuels absolutely everything there of any benefit to society because the entire City is a ginormous dump. Do a deep-drive through Camden and ask yourself – Is this place ever going to change for the better? Even the blind would answer no.

New Jersey currently pays (2020 statistics) in excess of $16,000 per child per year for public schooling.

Now if your New Jersey kids are sitting inside Emmaculate Heart Catholic High School – after you’ve forked over $30K to the Archdiocese for the privilege – what are you getting out of the real estate taxes you pay? You are paying for “other people’s kids” throughout your New Jersey County or hometown at the same time you’re paying big bucks for your kids to attend a Catholic School down the road. Why?

“Because I want my kids to be able to read, write and do ‘rythmetic” parents all cry out, voices choked with emotion. But wait – aren’t your tax dollars supposed to provide that in return for you paying your “fair share”? After all, the New Jersey State Constitution “guarantees” that “All resident children will get a thorough and efficient education at public cost….” New Jersey newspapers call it “T & E” – and it’s a constant editorial topic beause of Jersey’s extremely bad tax reputation and punishing cost of living.

Well, my friend – unless you crave the pathetic quality of public education most cities in New Jersey pumps out – keep paying Holy Mother the Church. There are exceptions to this rule: tony ‘bergs like Summit, Medford, Cherry Hill, Bernardsville, Haddonfield, Paramus, Englewood……

That’s why New Jersey people with money move to these cities – and the day after their prawns graduate High School, their houses sprout Century 21 or ReMax signs out front like magic. Why stay? The only reason they bough the house in the first place was to avoid paying twice for the education their kids got – ie. they opted to pay rediculously high real estate taxes in order to avoid having to pay for expensive private schools. Bottom line? Pay exorbitant real estate taxes or pay through the nose (or other orifice) to cultivate your kids’ brains.

New Jersey schools actually rank pretty high against other states. Comparatively speaking, we’re near the top nationally.

If you own a house in New Jersey, about three-quarters of your real estate tax bill goes to pay for other people’s kids to go to school – even if you haven’t reproduced, don’t plan on reproducing and hate children as bad as W. C Fields did.

A good many ideas have been run up the proverbial flag pole to address school tax inequality throughout the United States. A real estate property tax cap…. A national (ie. USA-wide) Constitutional Amendment requiring parents exclusively to pay their own offspring’s education K through 12… Endless flights of fevered brain fantasy. But the game always seemeed rigged in favor of “old reliable” – real estate tax.

In 1992 Colorado amended their state constitution to include “The Taxpayer’s Bill of Rights” or TABOR. It required that voters, not lawmakers, have the final say on all tax increases. Most importantly, it capped tax revenue. Anything the State of Colorado raised over and above the tax revenue cap (especially in Boom years) would (ostensibly) be returned to the taxpayers. Great idea, right?

Results? Very interesting….. TABOR slammed it’s foot down on the brake pedal of Colorado state government spending. Cost expenditures per student have fallen downward precipitously. Colorado now spends about $3000 less per student than the national average – somewhere between Mississippi and Alabama. Colorado regularly seeks authorizations from voters to withhold their “refund” checks in flush years so that the money can be redirected back to public education. NOTE: Colorado has to ask it’s voters to use this money!

Do people in Colorado send their kids to private schools? Of course they do – BUT they at least enjoy some control over their public education system. Even though they pay for an obligatory public education infrastructure they can still afford a better (private) education for their kids because their property tax is “manageable” (Colorado is considered a low property tax state) . It allows parents some budgetary wiggle room.

Colorado’s “system” isn’t perfect. But it does enable voters to decide what education cost expenditures per student in public schools will be. And people have the right to make that decision – even if it results in a per student dollar number that, in New Jersey, would make people soil their undergarmenets because it’s so low.

The heretofore sacrosanct presumption that “Public” schools are the only “fair” way to go are undeniably being challenged . States are struggling to find the”right” financing formula for their circumstances.

Michigan rejected New Jersey’s “Statewide Property Tax to Finance Public Education” paradigm years ago. They particularly rejected the Garden State’s core assumptions that spreading the property tax burdens statewide would expand financial stability and allow school districts to move away from a locally focused funding model. Michigan opts for a more “local” approach.

Michigan has a complex system that shunts tax dollars around – and it’s results are mixed. Michigan has many problems unique to Michigan but its legistlators are still committed to the idea that a statewide property tax system used primarily to fund public education is wrong. Local control of School Districts seems to be the philosophy there. Hybrid state and local tax programs have been proposed throughout the United States to correct inequities in urban vs. rural districts – of which Michigan has many – but no clear solution has been hit upon to date that satisfies everybody.

But what about about the eight hundred pound elephant in the room: TEACHER’S UNIONS…..

Fact is, there’s just too much money washing around the school finance debacle and too much interference from powerful Teacher’s Union Lobbyists to get very far down the road of reform.

Teacher’s Unions consistently and vigorously oppose each and every attempt to overhaul school funding formulas based on Real Estate taxes used in virtually every jurisdiction in the United States. Tenure, salaries, pensions, cradle-to-grave benefits all motivate Teacher’s Unions to oppose any and all change. Indeed, the Teachers always want more! They’ve been holding New Jersey hostage for generations. New Jersey Governors reduce themselves to blabbering, drooling sycophants whenever they address NJ Education issues – they can’t give enough. They split their pants bending over backwards for teachers. When Teacher’s Unions say jump, NJ Governors ask -“How high?”

It’s no surprise that a major disadvantage of a property-tax based school funding system is that individuals who have no children are woefully and repeatedly short-changed. But if you own a house or live in an apartment – the property (and school) tax number is factored into what you pay each month. It’s inescapable.

Have kids? People who send their TWO (for example) kids to private schools (because their public schools are below-par) are property-taxed just as heavily as a family who lives in a house in the same town (with the same approximate assessed dollar value) and has TEN kids, all going to public schools!

AND, statistically it can be proven that IF property values of houses drop – causing property tax revenue to drop – previous school tax assessments rarely, if ever, are adjusted downwards!

Once up, always up. School assessments never go lower.

The “Vicious Cycle” is: wealthy neighborhoods collect more in property taxes….which finance better schools…..that get more resources…..which leads to better student performance….and these students go to college……get better jobs……..make more money……themselves buy expensive houses in “good school” neighborhoods with high property taxes…….have kids….and start the process all over again.

“These “Good School” neighborhoods are a self-sustaining loop (actually a Cottage Industry) of commitments and expectations that all lead to – BINGO! High property taxes that keep it all greased. If you’ve got kids – get on the bus, Gus.

Our New Jersey Governor Murphy – unbelievably re-elected – blithely said it on Camera: “….If you’re sole issue is taxes, New Jersey probably ain’t your state!”

Here ALL money from the Garden State Parkway, Sales Taxes, Inheritance / Wealth Transfer Taxes, MV Registrations, NJ Turnpike, NJ Lottery, Cigarettes, Booze, Real Estate Transfer Taxes and every other NJ “Vig”….somehow always leaches its way back into the Public Education Financing nightmare that NJ residents drag around with them year after year. Taxes never go down.

Result? For the $16,000 (2020) per child tax money each child gets lavished on them in New Jersey, the end product is pitifully average.

A recent (2018) Rasmussen Poll on Real Estate Tax issues in the United States revealed that most Americans considered themselves “fleeced” by confiscatory property tax levies but conceded that without public schools “……illiteracy and incompetance would increase amoung the youth leading more individuals to become a drain on society by burdening our prison system….”

“Education” doesn’t seem to be the goal anymore….it’s all about stanching that bleeding wound we call “crime”. Dumb kids = crime. Crime = Prisons. And the Teacher’s Unions got us all by the curls.

The Grand-Daddy of all Tax Revolt movements was Proposition 13 in California. Back in 1978, people in the Golden State got pissed off paying high real-estate taxes and voted to rein it all in. In the 43 years since Proposition 13 Amended the California State Constitution to regulate property taxes according to a fixed formula favoring taxpaying real estate owners, many lessons have been learned.

Today, even under Proposition 13 Real Estate Tax calculation metrics that are supposed to keep these taxes stable, the real estate market itself – that is, incredible ever-rising property values – has driven real estate taxes to stratospheric levels.

While California is still less reliant on property tax to fund their school costs (property tax is about 30% of the total school budget) a kid’s “Zip Code” still determines the extent of “Resources” their schools have. The California system is “Bifurcated”. This means that certain school districts are considered “Property Value Wealthy” and are allowed to raise their school money in excess of state minimum funding levels (ie. Proposition 13 Metrics). “State Aid” school districts make up 90% of the school districts across California. They aren’t “Property Value Wealthy” – ie., they don’t have access to wealthy real-estate-tax-paying residents and, thus, have to rely – solely – on state aid.

The “State Aid” Districts get state monies allocated to them on a per-student formula. This scheme is used throughout the low-income (ie. low Real Estate tax valuation) areas.

Despite all this shell-gaming of “State Aid” – high real estate tax areas STILL fund the “Best” school districts, because their residents opt to fund their school budgets in excess of state minimum (Prop13) levels and have the right to do so! Parents know this – and, if they have the scratch – move to these rich areas in California for the good schools they offer. They pay a premium out of their own pocket. Just like in Paramus, Cherry Hill, Summit, Westfield, Medford and other towns in New Jersey.

Whatever analysis or metric you investigate referable to school district funding and public education finance one equation is constant: Good Neighborhoods = High Taxes = Good Schools. And the thread tying it all together is Property Taxes.

Linking school and per pupil education costs to Real Estate Taxes is still an issue in California; every state election at every level involves campaign promises to “revise funding mechanisms” for school funding. Nothing, as yet, has changed. California rolls on – year after year – like every other state with a patchwork quilt of school funding and “Three Card Monte” schemes crafted by bloviating politicians.

Pennsylvania recently proposed a bill to freeze property tax school levies. Cries that unrestrained property tax growth was damaging “local variation” of school districts were countered by arguments that a “freeze” would fuel “negative impact to low income students”. The “freeze” went nowhere.

PA Legistlators then proposed a “Property Tax Independence Act” seeking to de-link (their terminology) property taxes as the predominant school district funding source. Liberal school lobbyists and Teacher’s Unions railed against the Act, saying it would “take away local control of public schools and strip school districts of their ability to generate local revenue….”

Pennsylvania Teacher’s Union lobbyists (with their school administration union counterparts) insisted that “helping school districts that needed it most” was the answer…….and WHERE, praytell, did they propose to find the revenue needed to bankroll these “poor” districts? Three guesses……. By “equitable distribution” of monies from wealthy property-tax districts to poor ones. Nothing new here. Same old Teacher’s Union solution: take money from anywhere you can find it and throw it down the rat hole.

The state of Oregon funds its school districts (89%) from their state’s “General Fund” and State Lottery Fund coffers. “General Fund” is state income tax money. Use of local property tax money for education is limited to approximately $5.00 per every $1000 of property value assessed market value. Oregon, then, has shifted the bulk of its public school funding from local property / real estate taxes to “General Fund” taxation – ie., income tax, MV Fees, Gasoline Taxes, Sales, Lottery, etc.

Based on the ebb and flow of these funding tax streams, Oregon crafts a new formula each year to spread money among its school districts. This formula is fine-tuned to “address public education equity”. Some years are “flush” years – some are “lean”. The formula is adjusted acccordingly – but is is certainly not “Peoperty Tax Centric”.

While its education funding system isn’t perfect, Oregon has at least shattered the “glass wall” of slavish reliance on property tax alone as the sole and/or predominant source of K thru 12 financing. See www.walletthub.com (“Statistics and Studies”) for property taxes by state (John S. Kiernan, Managing Editor, 2/23/21) and an interesting break-down of State Real Estate Tax Ranking for Educational Funding from lowest in the USA to the highest. Of course, the highest is New Jersey with an effective real estate tax rate of 2.49%.

The second highest is Illinois at 2.27% where property taxes pay the bulk of educational funding.

CONCLUSION

No state in the United States of America has completely abandoned the use of property tax as a source of revenue for public education, K thru 12. Some states (Michigan, North Dakota and Oregon) are trying to shift their reliance from property tax “Centric” to other funding sources – with varying degrees of success.

Why is this so hard? Short Answer? Predictability of Revenue Collection is the reason for its intractable staying power. Real estate tax is dependable….reliable….sacrosanct. Nobody plays around with the roof over their heads unless they’re ankle deep in doo-doo. Governments know it. Teacher’s Unions know it. Teacher’s Lobby dirtbags know it.

If states were to do away with property tax “Centric” educational financing for their K thru 12 grades, they’d have to replace this funding with other “revenues” – income taxes, sales taxes, corporate, lottery, cigarette, booze, marijuana (recently), excise taxes……..These taxes are always more “volatile” and changeable. They wax and wane. Some years are good – some years are not so good. Property taxes are a sure bet.

So what is the antidote for high property taxes?

Simple as it sounds: stop having babies. And if you do birth a child, be prepared to pay for its educational freight K thru 12, college and beyond. If you can’t afford a kid, don’t have a kid. If I chose not to have any kids, don’t ask me to pay to educate yours. Ultimately, fewer kids means fewer schools will be needed. Then the Teacher’s Unions will finally be disarmed – and we can have a frank discussion about lowering our property taxes.

In the meantime, real estate tax is and will continue to be the backbone of K thru 12 public education funding.

Ideas?

Maybe parents should at least be required to pay a Per Child Premium (Head Tax) in addition to their real estate tax base payment IF they have more than two kids. Replace you and your wife on this rotating marble in the cosmos. Have any more babies and you pay for them. Keep private your religious beliefs and stop banging drums about your “civil rights”.

If the most pursuasive argument for confiscatory real estate taxation you can make is: “School now or prisons later!” …..we got a long way to go.

Copyright, Jon Croft, 2021.